Unreimbursed Employee Business Expenses 2025

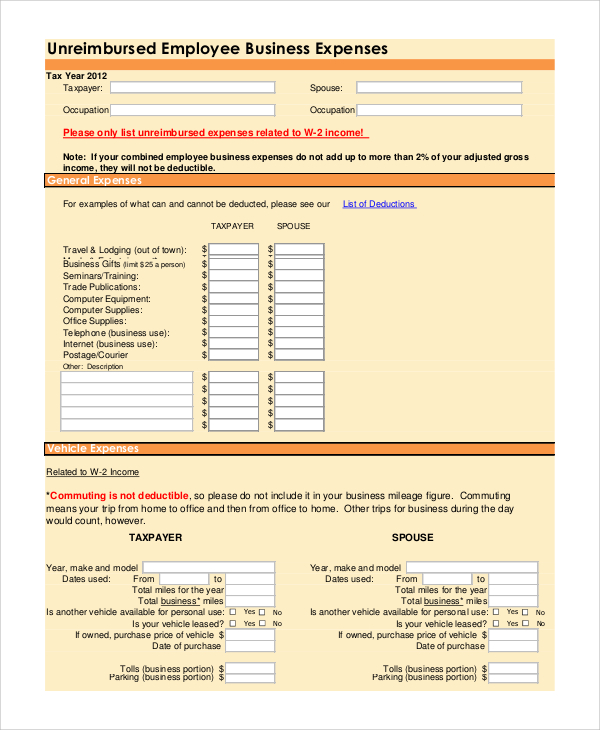

Unreimbursed Employee Business Expenses 2025 - Individual Alternative Minimum Tax Planning and Strategies ppt download, Who can deduct unreimbursed employee business expenses? Unreimbursed Employee Expenses YouTube, Fill in all of part i if you were reimbursed for employee business expenses.

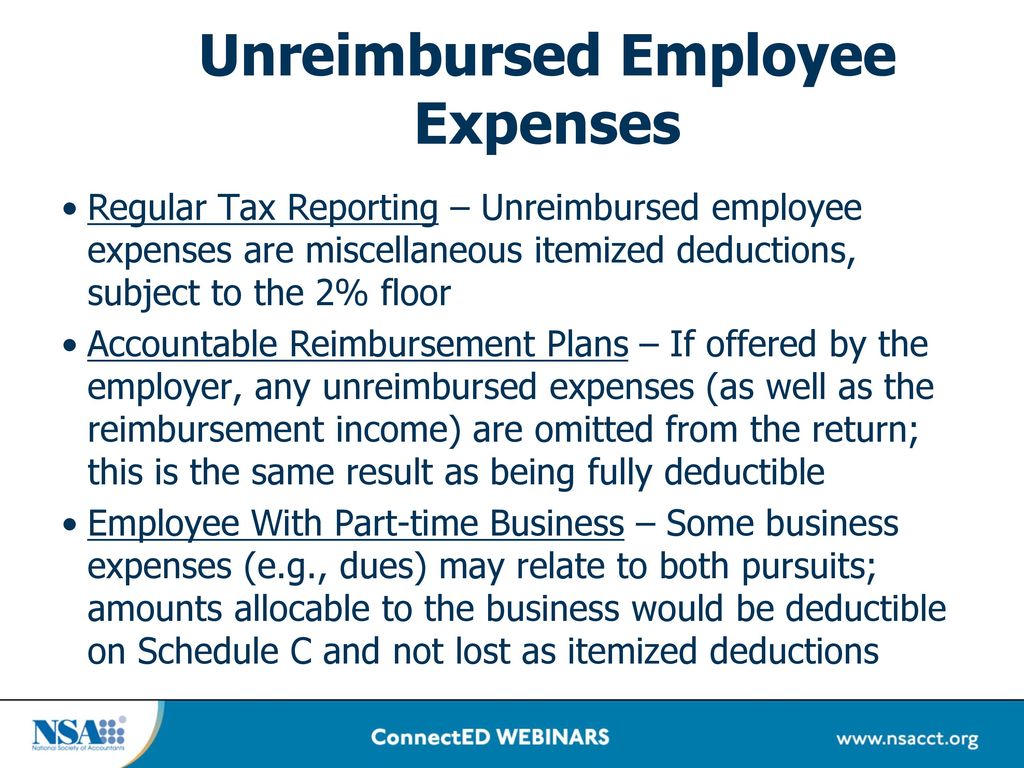

Individual Alternative Minimum Tax Planning and Strategies ppt download, Who can deduct unreimbursed employee business expenses?

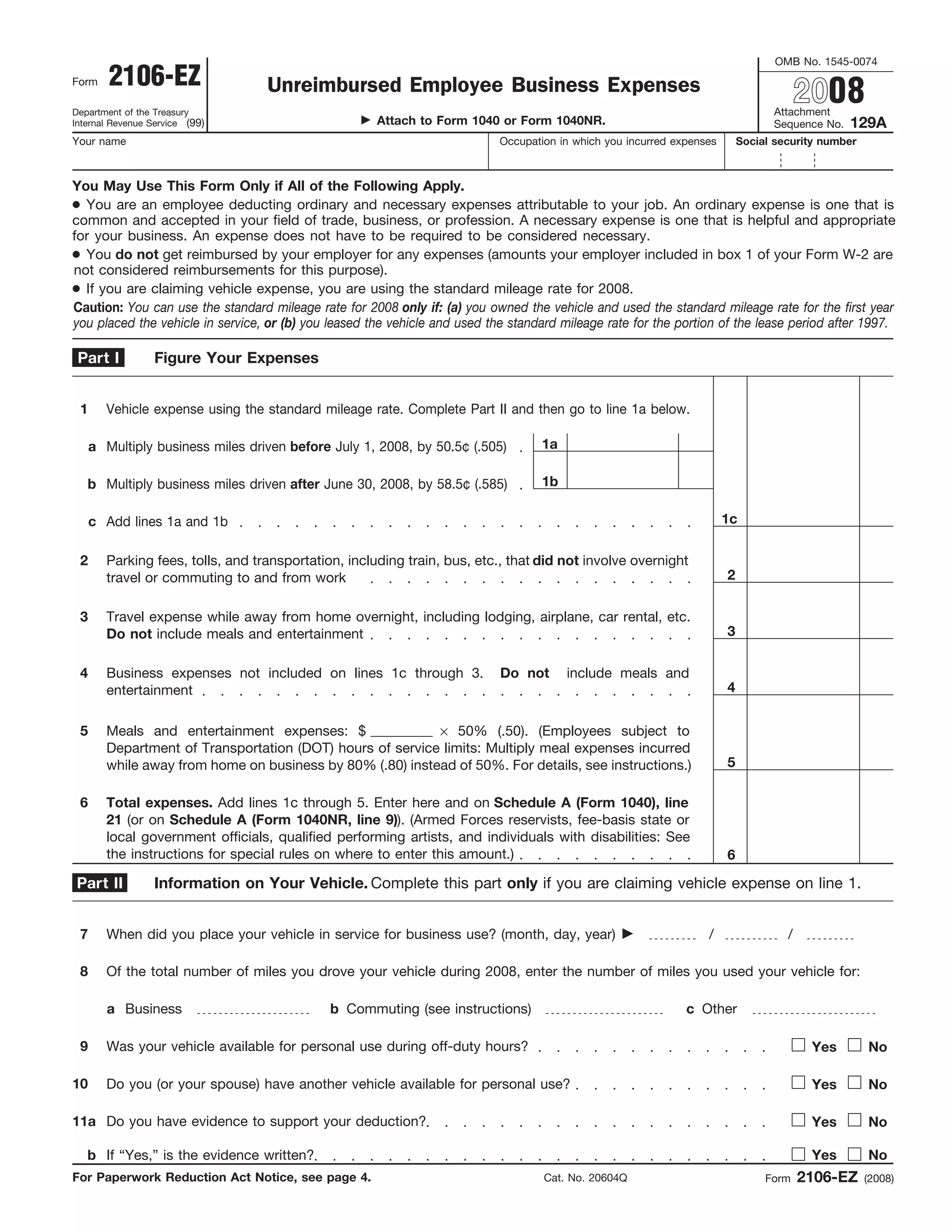

Form 2106EZUnreimbursed Employee Business Expenses PDF, Taxpayers may only deduct unreimbursed employee expenses that are paid or incurred during the current tax year, intended to enable the taxpayer’s trade or business of.

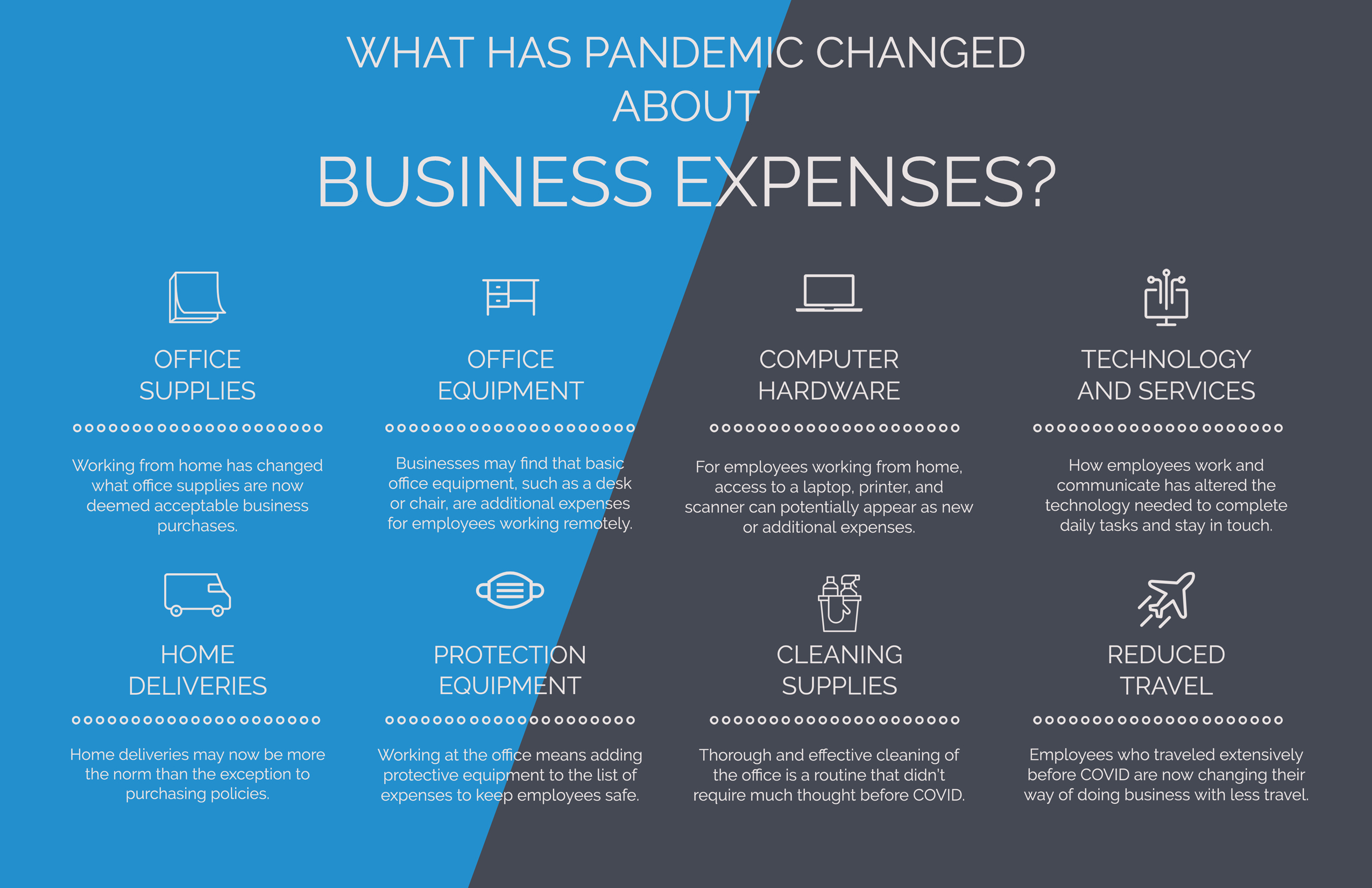

Employee Business Expenses Deduction 2025 Terza, Unreimbursed business expenses are ordinary and necessary expenses incurred by a partner or shareholder which are not reimbursed.

Unreimbursed Employee Expenses What are they? Akaunting, The tcja eliminates the deduction for unreimbursed employee business expenses for tax years 2025 through 2025.

Unreimbursed Employee Business Expenses 2025. 162 (a), there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the tax year in. If you weren't reimbursed for your expenses,.

Typical unreimbursed expenses such as hotel costs, airfare, parking, mileage, and rental car fees were allowable deductions until tcja suspended 2% miscellaneous deductions through 2025. Due to the tax cuts and jobs act of 2025, most unreimbursed employee business expenses are no longer deductible for tax years 2025 through 2025.

2025 Business Expenses Penni Blakeley, Taxpayers may only deduct unreimbursed employee expenses that are paid or incurred during the current tax year, intended to enable the taxpayer’s trade or business of.

Can You Deduct Business Expenses In 2025 Lorne Rebecka, Typical unreimbursed expenses such as hotel costs, airfare, parking, mileage, and rental car fees were allowable deductions until tcja suspended 2% miscellaneous deductions through 2025.

FREE 6+ Sample Unreimbursed Employee Expense in PDF, From 2025 to 2025, the tax cuts and job act (tcja) has eliminated all miscellaneous itemized deductions subject.

Tackling Unreimbursed Business Expenses Full Guide ReliaBills, Who can deduct unreimbursed employee business expenses?